Business Insurance in and around Laurel

One of Laurel’s top choices for small business insurance.

This small business insurance is not risky

Insure The Business You've Built.

Preparation is key for when the unexpected happens on your business's property like a customer slipping and falling.

One of Laurel’s top choices for small business insurance.

This small business insurance is not risky

Insurance Designed For Small Business

With State Farm small business insurance, you can give yourself more protection! State Farm agent Lori Hearn is ready to help you prepare for potential mishaps with dependable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Lori Hearn can help you file your claim. Keep your business protected and growing strong with State Farm!

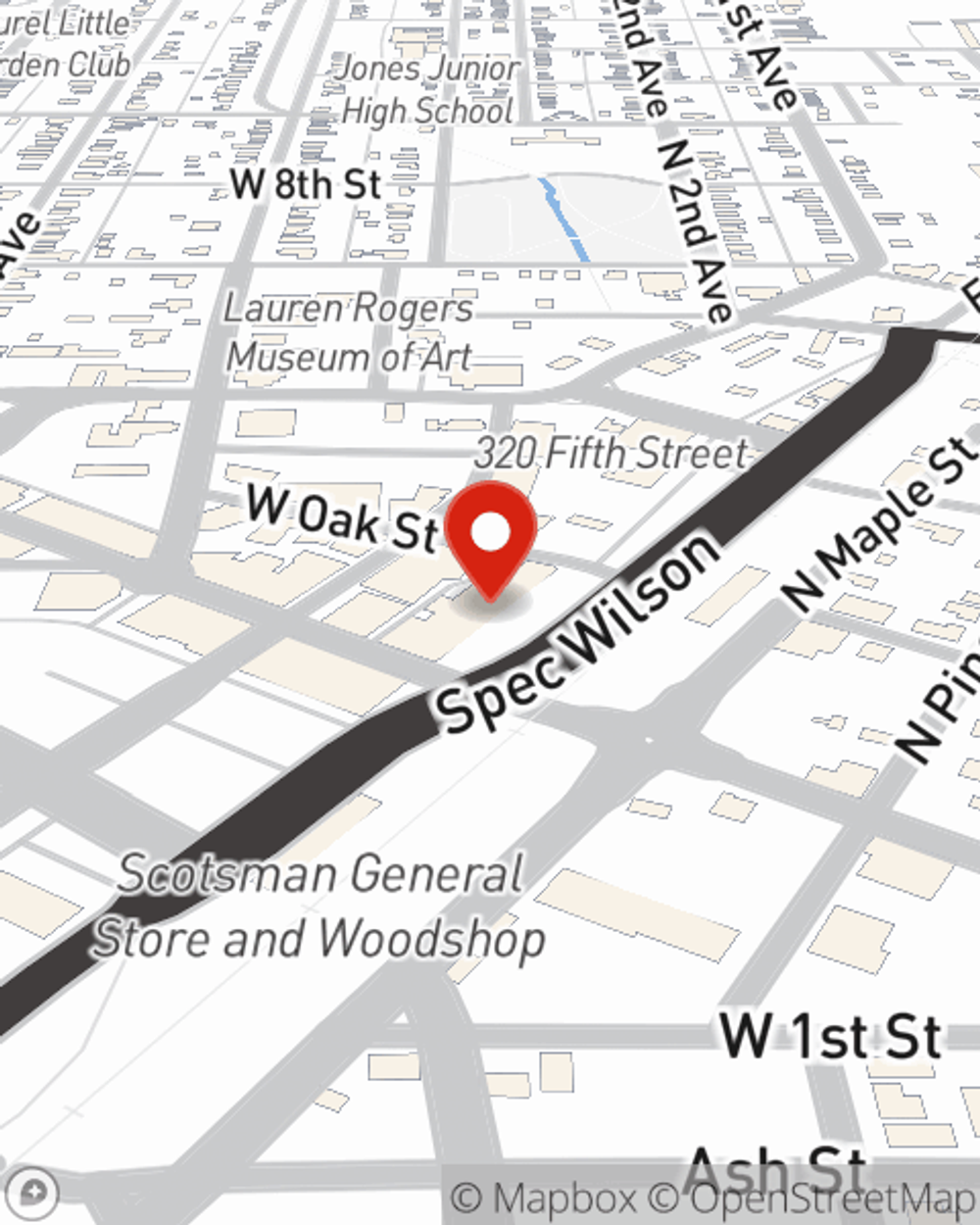

Curious to investigate the specific options that may be right for you and your small business? Simply contact State Farm agent Lori Hearn today!

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Lori Hearn

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.